Who's Who in the Zoo – The 3 Ws of Management Rights

Unlike other conveyancing transactions, management rights matters have more parties than people realise and can often cause confusion about:

Who is who;

Who can talk to who, and

Why certain people cannot talk to others.

It is a pretty important paradigm to understand and one that is often misunderstood, even by experienced advisers. Let’s take a look.

1. Who is who?

(a) The Seller

This can either be a developer (if buying off the plan) or the owner of a business. Where there is a unit associated with the business, depending on how the agreements are structured, there may be one seller (the same entity that owns the unit and the business) or there may be two sellers (the owner of the business who is different from the owner of the unit).

(b) Selling agent/broker

This is the person the seller appoints to sell their business and is a licensed real estate agent. There are agents that specialise in selling management rights, it is important that a seller uses a management rights agent, as there are particular matters the agent must be aware of when selling these businesses. This is not too dissimilar to an agent you appoint to sell your house – the agent works for the seller to achieve the best outcome on the sale.

Once upon a time, agents would prepare the sale contract; however, over time, with changes to legislation prohibiting agents being able to write conditions, preparation of contracts is something that a seller’s solicitor will generally do.

The agent/broker will sometimes, but not always, hold the deposit and is responsible for following up payment of the balance deposit at the appropriate time.

Love them or hate them, the seller’s agent is necessary in selling management rights businesses and is essential where there may be a difficult buyer or seller or one that is hard to contact.

(c) Seller’s experts

These include:

(i) the seller’s accountant, this will be the accountant the seller has been using in their business and is often the accountant who has prepared the P&L’s to work out the sale price and the contact the buyer’s accountant can speak with if there are any queries on the P&Ls;

(ii) the seller’s financier who currently holds security over the business and is responsible for releasing any mortgage and/or security interests held over the seller’s business/unit. The financier will also hold the original agreements, which are required to be handed over at settlement to the new financier;

(iii) the seller’s solicitor, who is engaged by the seller to act in the sale, which starts with the preparation and negotiation of contract/s, responding to queries in relation to the buyer’s conditions, advising the seller on its rights and obligations and proceeding to and attending settlement.

(d) Buyer

This is the person/company who is buying the business (and unit, if there is one). As with the seller, depending on how the agreements are structured, the buying entity may be the same for both the business and unit or may be different.

(e) Buyer’s representatives

These include:

(i) the buyer’s accountant who is engaged to verify the income disclosed in the contract (and the P&Ls). The accountant will also be engaged to check the letting appointments the seller holds, and is the only representative that ordinarily undertakes a physical inspection of the business records;

(ii) the buyer’s financier, who assists the buyer with funding its purchase. There are various financiers who offer funding for management rights acquisitions - it is important to choose a financier with experience with such purchases;

(iii) the buyer’s solicitor who is engaged by the buyer to act in the purchase, including negotiating the purchase contract/s, undertaking a legal due diligence review, dealing with the buyer’s accountants and financiers in relation to the buyer’s conditions, advising the buyer on its rights and obligations and preparing a buyer for the steps involved in obtaining body corporate consent through to settlement of the contract/s.

(f) The Body Corporate

Again, there are various parties that make up the body corporate side of a transaction, as follows:

(i) the body corporate manager – this is the strata manager appointed by the body corporate to assist in the administration of the scheme and is usually the first point of contact when a seller formally requests the consent of the body corporate to the assignment;

(ii) the committee – these are the representatives of the body corporate who are volunteers and are (generally) able to consent to the assignment;

(iii) the body corporate’s solicitor – in 9 out of 10 matters, the body corporate will appoint its own solicitor to assist the committee navigate the consent process; and

(iv) independent experts – committees, are becoming more attune to the responsibility that rests upon them when considering an assignment and are asking independent consultants to assist them with that process. The consultant’s role is usually to assist in interviewing the proposed buyer with a view to report back to the committee with their findings and/or recommendations for further training (if that is required).

(g) Franchised and/or leased businesses

Things can get further complicated where a business is part of a franchise, which adds yet another layer of advisers. The same goes for a business which is operated from partly or wholly leased premises. For the purpose of this article, we won’t complicate things, by including in this further dynamic, we will stick with the “standard” parties in a management rights sale.

2. Who can talk to who?

Unfortunately, there is a misconception in the industry about who is entitled to information and who can contact various parties’ advisers. If a party refuses to speak with you, there is usually a good reason for that – you should ask yourself these questions:

Whose adviser/party are you trying to speak with?

Did you engage them?

Are you paying them for their advice?

The answers will reveal whether you have the “right” to talk with them.

3. Why x and y can’t talk to various parties?

Simply put, because they do not act for you!

Over the years, when acting for a buyer or seller, we have been contacted by committee members, the seller/buyer directly and the seller’s agents, where we have had to refuse to discuss matters with them – not because we dislike them, but because we have either been specifically instructed by a client not to speak with a certain party or because we are ethically bound not to speak to that party.

Solicitors have strict ethical rules and responsibilities when acting for a party in a transaction, which must be upheld. There are significant consequences where a solicitor fails to comply with these rules and standards.

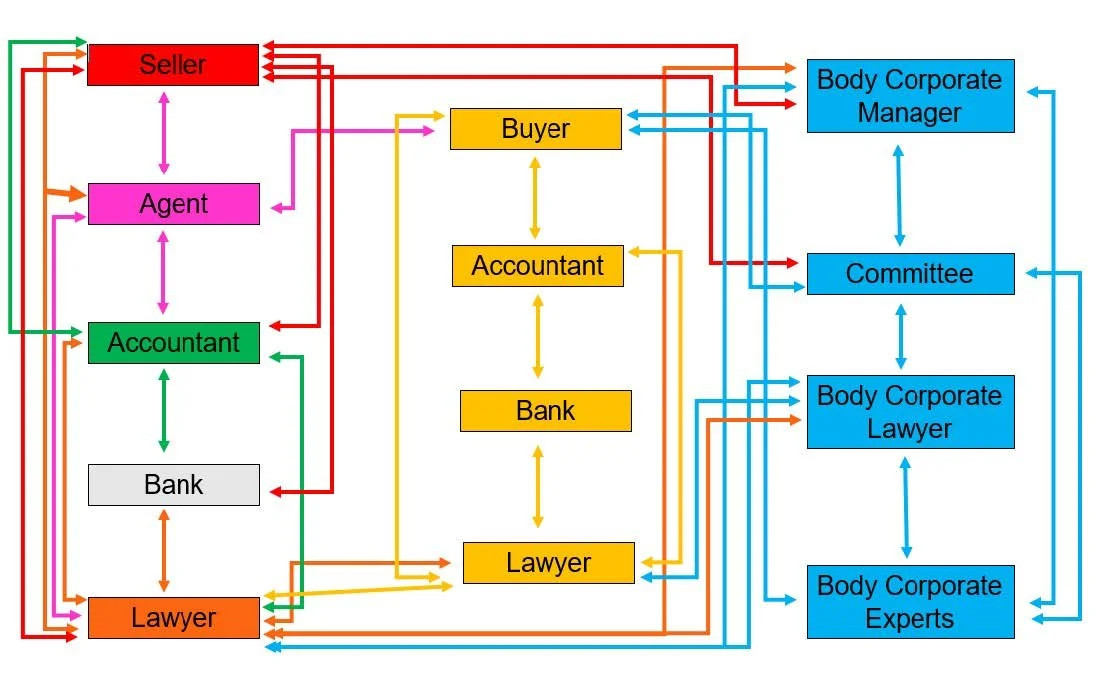

The following diagram attempts to illustrate who can talk with whom during a management rights transaction:

The management rights paradigm of the 3 Ws

How can Quartz Legal QLD help?

If you have any questions, please reach out to us at info@quartzlegal.com.au.